Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Amazon on Tuesday said it was testing a fast-track shopping service in India that will see the US tech giant deliver groceries and other items to customers in the world’s most populous country in 15 minutes or less.

The American firm is the sixth major player in India’s fast-paced trading market, viz Currently, annual sales exceed 6 billion dollars. Backed by Zomato-owned BlinkIt, Swiggy and Nexus, Zepto currently dominates the fast-paced commerce game with operations in nearly two dozen cities in India.

Amazon said it initially launched the pilot in Bengaluru.

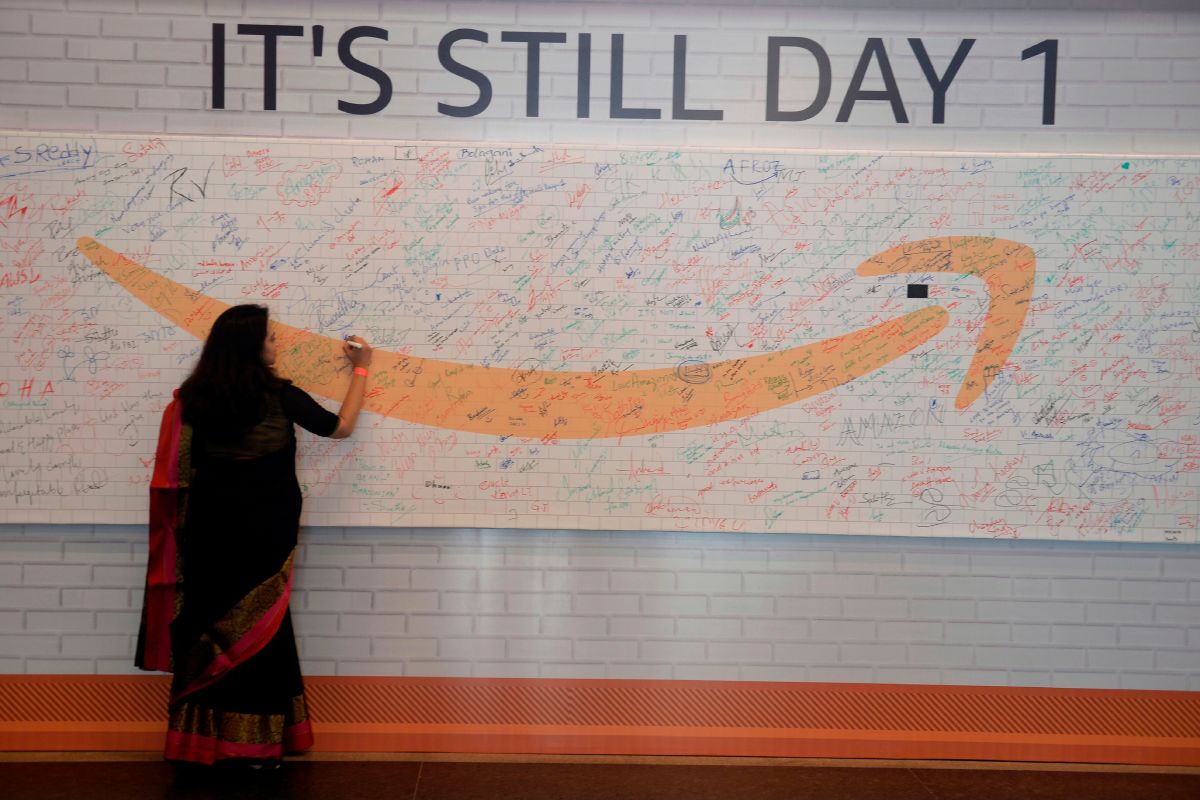

“Our strategy has always focused on ‘Choice, Value and Convenience’ and our vision is to build a highly profitable business in India,” said Samir Kumar, the new country manager of Amazon India.

“So, while we focus on delivering on our strategy of offering customers the largest selection at the fastest speed and highest value in every pin code across the country, we’re excited to give our customers the choice to get their everyday options. The basics in 15 minutes or less.”

While the fast-track commerce model — delivering products to customers within 10 to 15 minutes — doesn’t work in most parts of the world, it’s increasingly successful in India, where a number of retailers and internet firms, from grocery delivery giant Swiggy, have adopted it. online cosmetics platform Nykaa is preparing its supply chain ecosystem to adapt to faster deliveries.

Myntra, the top fashion e-commerce player in India, tested the fast trade offer in Bengaluru last week.

India is the only market where Amazon is testing its express commerce offering. It is also one of the biggest steps in the world’s second largest internet market.

Amazon entered the Indian market a decade ago, investing over $7.5 billion to build and expand its e-commerce offering. But 10 years later, India’s e-commerce market has barely scratched the $1.1 trillion retail market and is growing at less than 15% annually.

Some industry insiders as well as analysts believe that e-commerce could be the future of e-commerce in India. Amazon’s main Indian competitor, Flipkart, launched its fast trading offer in August.

By comparison, the rapid commerce market is poised for exponential growth, growing sixfold between FY24 and FY27 to a total addressable market of $27 billion, according to CLSA forecasts.

The segment, which currently accounts for 3% of the grocery and 1% of the retail market, is expected to expand to 5% and 2%, respectively, within a decade, CLSA said in a report on Tuesday.

Many also criticized Amazon Very slow in India. Bernstein analyst Rahul Malhotra told TechCrunch in a recent interview that Amazon failed to capitalize on white space in categories like e-commerce, Tier 2 marketplaces and apparel.