Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

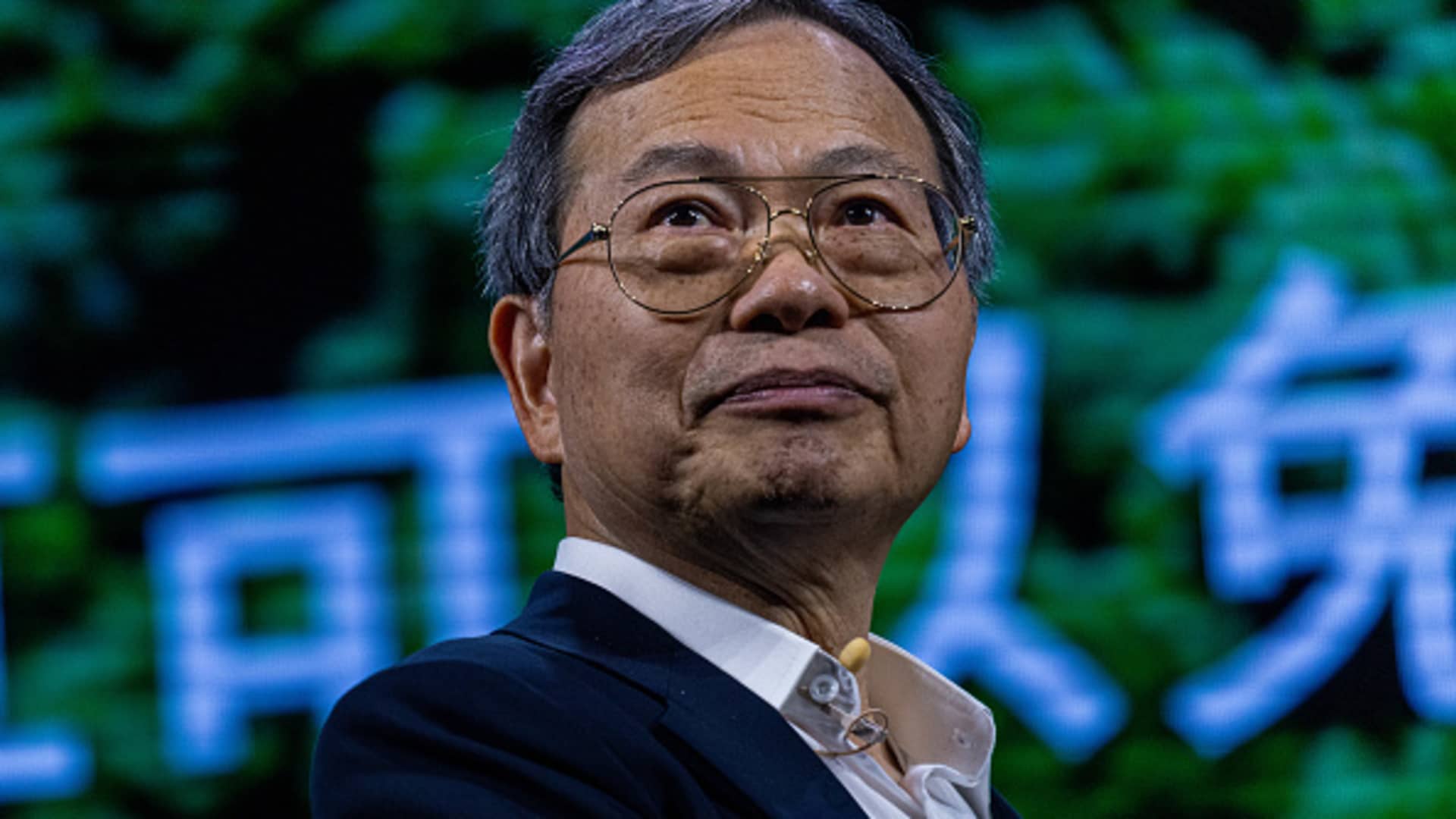

Charles Liang, CEO of Super Micro Computer, at the Computex conference in Taipei, Taiwan, on June 5, 2024.

Annabelle Chih | Bloomberg | fake images

super microcomputer joined the Nasdaq 100 in July. Five months later, it came to light and the shares fell 8% after the news.

Nasdaq said late Friday that Super Micro is being removed from indexwhich is made up of the top 100 non-financial stocks on the Nasdaq and is the basis of the Invesco QQQ Trust exchange-traded fund, one of the most actively traded ETFs.

The announcement is the latest in a rollercoaster year for Super Micro, whose shares soared to a record $118.81 in March as demand soared for the company’s servers packed with artificial intelligence processors. . The company’s market capitalization reached more than $70 billion, high enough to deserve inclusion in the S&P 500.

Super Micro is now worth about $20 billion, about a quarter the size of the average market capitalization of companies on the Nasdaq 100. Nasdaq will also eliminate glow up and Modern of the group, starting December 23.

The revision will leave room for additions to Axon Company and Palantir Technologiesas well as Microstrategya company whose value is linked to its billions of dollars in bitcoins shopping. MicroStrategy shares have gained more than 500% so far this year and were flat in trading on Monday.

For Super Micro, the story began to change in August, when the company said that would not present your annual report to the SEC on time. Prominent short seller Hindenburg Research then revealed a short position in the company and said in a report that it had identified “new evidence of accounting manipulation.”

In October, Ernst & Young resigned as Super Micro’s auditor, leading to a 33% drop in shares. A special independent committee of the board evaluated Ernst & Young’s concerns and found no misconduct after a three-month investigation. The report recommended that the company replace its chief financial officer. The company said in November that BDO was its new auditor.

Super Micro was at risk of being delisted from the Nasdaq for the second time due to delays in its financial reports, but two weeks ago received an extension until February 2025.

In a preliminary earnings report, the company said third-quarter revenue increased 181% year over year. below consensus.

“Competition is strong, but I think we’re in a good position,” CEO Charles Liang said during a conference call with analysts in November. Rivals include Dell and HPE.