Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

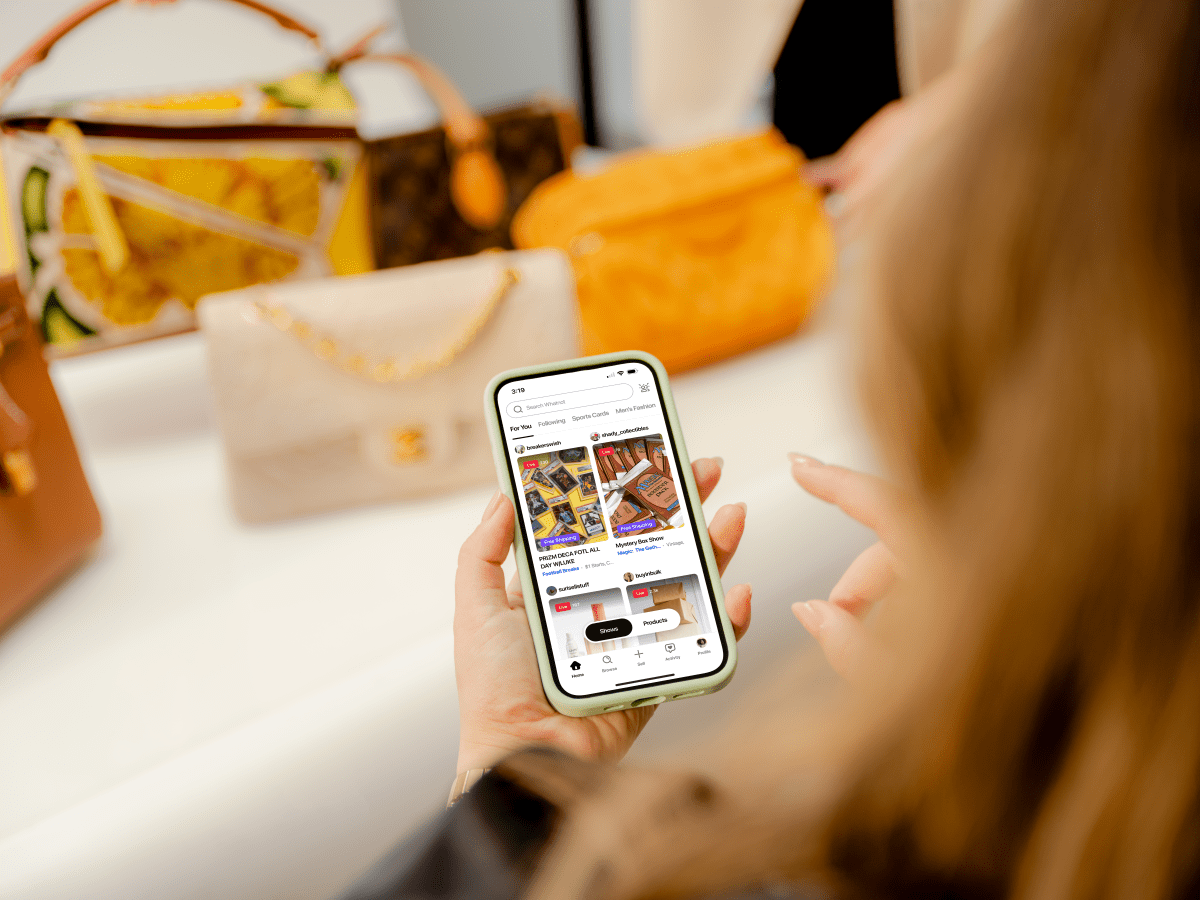

What notThe platform, which allows users to sell items like trading cards, comics and sneakers via live videos, announced Wednesday that it has raised $265 million in a Series E funding round, a significant investment for the live streaming shopping platform. The round values Whatnot at $4.97 billion.

The investment marks an important milestone for Whatnot and highlights the growth potential of live shopping in the US. The substantial amount raised reflects investors’ confidence in Whatnot’s ability to further innovate in the space, particularly in Whatnot’s focus of collectibles and niche items.

The new capital will be used to expand into more categories including art, golf and vinyl. Whatnot is also working on new seller tools designed to help sellers grow their business. One of these tools aims to simplify inventory and order management for sellers.

Whatnot plans to launch in Australia next month, as well as other markets in Europe later this year. Currently available in USA, UK, Canada, France, Germany, Austria, Netherlands and Belgium.

Founded in 2019 by Grant LaFontaine and Logan Head, the Whatnot platform is designed for collectors today and differentiates itself from competitors focused on fashion and beauty products. Initially focused on sports trading cards, action figures, comics and memorabilia, over time accessories, apparel, electronics, live plants, etc. expanded to include

A key feature of the platform is its “sudden death” auctions, where the last bidder wins the item. Whatnot recently introduced a new sales method called flash sales that allows sellers to offer customizable, time-sensitive discounts on products. A countdown clock during live broadcasts creates a sense of urgency among buyers. Last year, the platform launched a new rewards tool that allows buyers to receive rewards from sellers after completing certain achievements and leveling up.

Along with the funding announcement, Whatnot said it plans to launch an initial public offering to buy back $72 million worth of shares. The company told us the move reflects its commitment to invest in its 600 full-time employees. Stock buybacks often indicate that a company is performing well and can invest in its workforce through wages, benefits or other investments.

The round was led by Avra, DST Global and Greycroft with participation from Andreessen Horowitz (a16z), CapitalG, BOND, Durable Capital Partners and Y Combinator. To date, Whatnot has raised approximately $746 million.

Whatnot also revealed that the annual gross merchandise value (GMV) for live streaming sales has recently surpassed $3 billion. to report Annual GMV of over $2 billion.