Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Stay informed about free updates

Just register to go The war in Ukraine myFT Digest — delivered directly to your inbox.

EU shipyards are refurbishing Russia’s ice-bound ships and providing them with dry docks, enabling Moscow to continue shipping gas to the Arctic despite western sanctions in the sector its power.

Without maintenance work – provided by the Damen shipyard in Brest, France, and Fayard A/S in Denmark – Russia’s Yamal LNG plant would struggle to find key markets during the winter when prices of the northern world’s gas is very high.

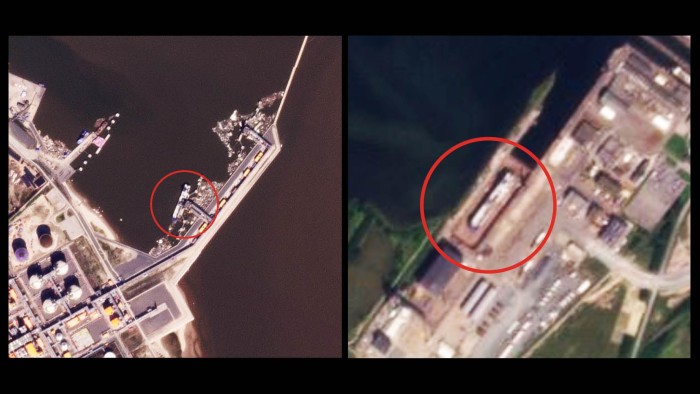

The two yards have handled 14 of the 15 Arc7 specialty vessels sailing from Yamal LNG on Russia’s northern coast, according to satellite images and mobile tracking data from Kpler, k a data and analytics company. Some ships called multiple times.

Malte Humpert, an Arctic shipping expert at High North News who has monitored shipping movements, says: “If those two ports were not allowed, it would put the entire cargo operation in jeopardy.” They could get service elsewhere, but that would mean going out of their way.

Eight vessels have called on Damen, while Fayard has commissioned nine since Russia invaded Ukraine in January 2022. Most of the vessels are owned by energy and shipping companies including Greece’s Dynagas.

Damen confirmed that it had repaired “several vessels involved in the transport of Russian LNG” but added that it “strictly adheres to European sanctions” and that it “does not interfere with the cargo selections made by shipping companies operating these ships”.

“No further maintenance of these LNG vessels is planned in the near future,” it said.

Fayard did not respond to a request for comment.

Eliminating Russian gas is a major policy objective of the European Commission. However, its goal of reducing the EU’s use of Russian fossil fuels to zero by 2027 has been overturned by an increase in Russian LNG imports, mainly supplied by Yamal.

Shipyards and yards are not allowed because they are designed for energy transport and because they do not have a Russian flag, and special tanks will not be able to distribute their goods without technical knowledge and attention to leave the yards of Europe.

The only ship that did not make it to either of these two yards was the Christophe de Margerie, which belongs to the Russian shipping company Sovcomflot.

The EU agreed to authorize the ship itself – the first step from the bloc to impose any sanctions on Yamal activities – on December 16. The US has already hit the Yamal project with waves of sanctions. .

Christophe de Margerie’s inability to access repair yards in Europe put the ship out of service for six months, showing Arc7’s dependence on European know-how and parts, Humpert said.

From Yamal, ships can either head for Europe or take the long and dangerous North Sea route to China. The route to the east can only be operated during the warmer months, although Novatek – the owner of Yamal LNG – is experimenting with a longer supply window.

The Arc7 LNG carriers were built in South Korea at a cost of about $333mn per ship, according to research by the Oxford Institute for Energy Studies.

They are more than 200m long and can hold up to 170,000 cubic meters of natural gas with an “Azipod” specially designed to transport thick ice.

One European ship dealer said French and Danish yards, which have dry docks large enough for larger vessels, are the only ones “that can handle Arc7s and at the same time” one is in the right place”.

While Russian crude oil and coal have been ordered, gas remains outside the bloc’s sanctions regime amid concerns about security of supply.

In the first step to end gas exports, EU countries agreed in June to ban from March the transit of Russian LNG. This will stop EU ports being used to transfer gas from ice tankers to cheaper conventional ships for export.

Yamal LNG exported 20.9bn cubic meters to Europe in 2023, according to OIES, of which almost a quarter was exported to regions outside the bloc. Yamal exports make up 85 to 90 percent of Russia’s LNG exports, according to the Bond Beter Leefmilieu tanker.

Additional report by Shotaro Tani in London

This article has been corrected to clarify who currently owns the tank cars.