Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

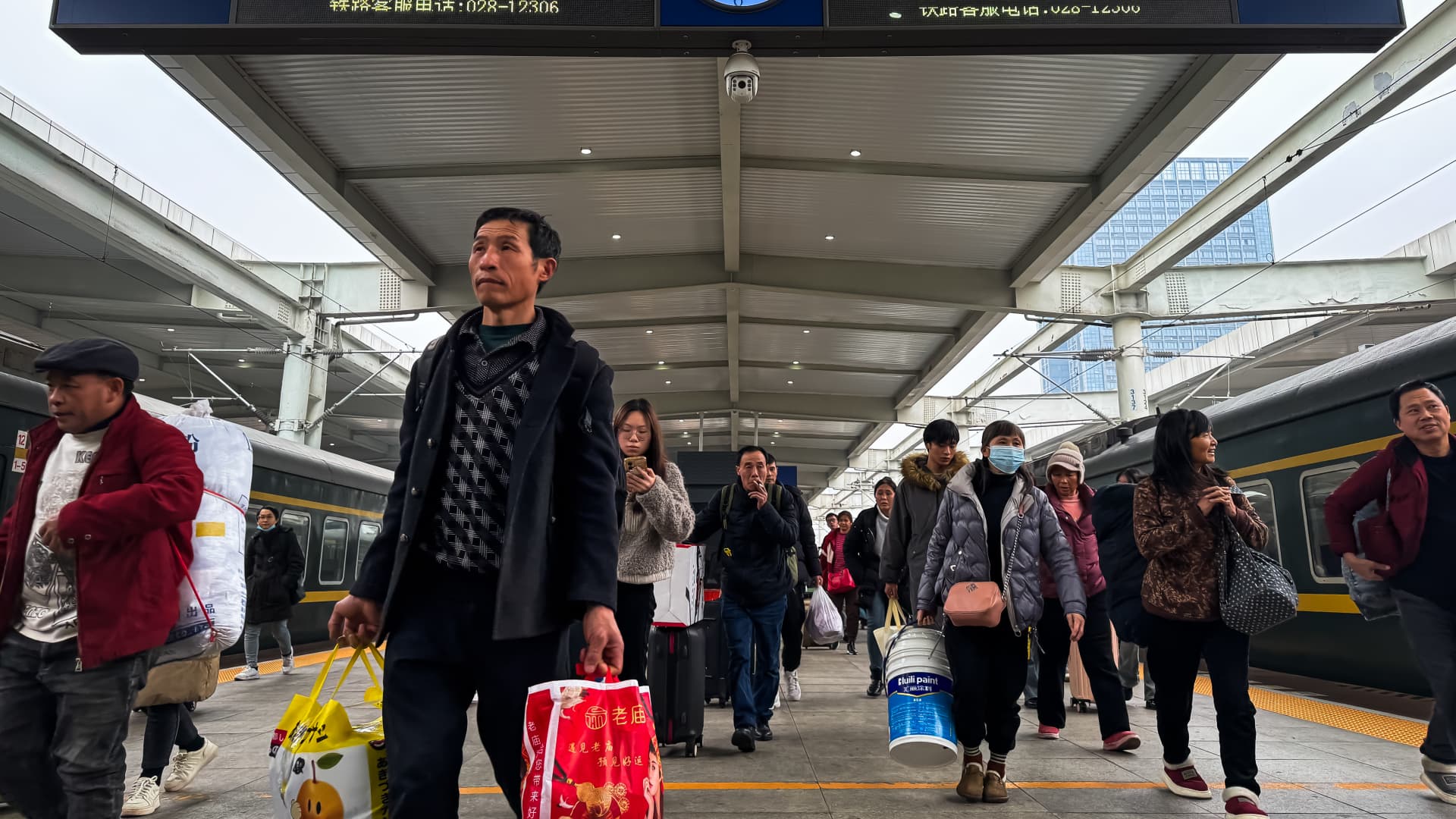

Passengers walk along the platform after disembarking from a train at Chongqing North Railway Station during the first day of the 2025 Spring Festival peak travel season on January 14, 2025.

Cheng Xin | Getty Images News | fake images

BEIJING – With promised government support yet to materialize in any significant way, China’s economy has yet to experience the turnaround investors have been hoping for.

While authorities have cut interest rates and announced sweeping stimulus plans since late September, details on the long-awaited fiscal support likely won’t be known until an annual parliamentary meeting in March. Official GDP figures for 2024 will be published on Friday.

“China’s fiscal stimulus is still not enough to address headwinds to economic growth…We are cautious long-term given China’s structural challenges,” BlackRock Investment Institute said in a weekly report on Tuesday. The company, which is slightly overweight Chinese stocks, indicated it was willing to buy more if circumstances changed.

Meanwhile, falling domestic demand and concerns about deflation are becoming more urgent. Consumer prices barely rose in 2024, just 0.5% after excluding volatile food and energy prices. It is the slowest increase in at least 10 years, according to records available in the Wind Information database.

“Consumer spending remains weak, foreign investment is declining and some industries face growth pressures,” Yin Yong, mayor of the city of Beijing, said in an official annual report on Tuesday.

The capital is targeting consumer price inflation of 2% by 2025 and aims to boost technological development. While national economic targets will not be released until March, senior economic and financial officials have told reporters in the past two weeks that fiscal support is in the works and that the issuance of ultra-long bonds to stimulate consumption would exceed the from last year.

The stimulus announced by China will begin to take effect this year, but it will likely take time to see a significant impact, Mi Yang, head of research for northern China at property consultancy JLL, told reporters in Beijing last week.

Pressure on the commercial real estate market will continue this year and prices may accelerate their decline before recovering, he said.

Rents in Beijing for high-end, so-called Grade A, offices fell 16% in 2024 and are expected to fall almost 15% this year, with some rents even approaching 2008 or 2009 levels, according to JLL.

In 2024, new shopping centers opened in Beijing with average occupancy rates of 72%; Previously, such malls would not open if the rate was below 75% or much closer to 100%, JLL said. However, in one year, the new shopping centers recorded occupancy rates of 90%, the consultancy firm stated.

Unlike the US During the Covid-19 pandemic, China did not provide cash to consumers. Instead, In late July, Chinese authorities announced 150 billion yuan ($20.46 billion) in ultra-long bonds for exchange subsidies. and another 150 billion yuan for equipment upgrades.

China has already issued 81 billion yuan for this year’s exchange program, officials said this month. It covers more home appliances, electric cars, and a discount of up to 15% on smartphones priced at 6,000 yuan or less.

Consumers who buy premium phones tend to upgrade and recycle their devices more frequently than buyers at the lower end of the market, indicating that the government may want to encourage a new group to shorten their upgrade cycle, said Rex Chen, CFO of ATRenew, which operates stores for processing smartphones and other second-hand items.

Chen told CNBC on Monday that he expects the exchange subsidy program can increase recycling transaction volumes of eligible products on the platform by at least 10 percentage points, up from 25% growth in 2024. He also expects the government carry out a similar exchange. -in politics for the coming years.

However, it is less clear whether the exchange program alone can lead to a sustained recovery in consumer demand.

Nomura’s chief China economist Ting Lu said in a report on Tuesday that he expects sales momentum to fade in the second half of this year, and that tepid new home sales will limit demand for home appliances.

Real estate and related sectors, such as construction, once accounted for more than a quarter of China’s economy. When the central authorities began to crack down about high levels of developer debt in 2020, which had ripple effects on the economy, along with the Covid-19 pandemic.

China changed its stance on the real estate sector in September following a high-level meeting led by President Xi Jinping calling for stop the decline of the sector.

Measures to shore up the sector include the use of a whitelist process to complete the construction of the numerous apartments that have been sold but not yet built due to the financial constraints of the developers. New apartments in China are usually sold before completion.

Jeremy Zook, senior China analyst at Fitch Ratings, said the property market had not yet bottomed and authorities could provide more direct support. He noted that it was difficult for the economy to abandon the real estate sector, despite China’s wishes to reduce its dependence on the sector for its growth.

The government’s latest measures have contributed to the overall stock market rally and slightly lifted confidence.

New home sales in China’s largest cities over the past 30 days have increased nearly 40% from a year ago, Goldman Sachs analysts said in a Jan. 5 report.

But they warned that high inventory levels in smaller cities indicate that property prices “have more room to fall” and that housing construction “is likely to remain depressed in the coming years.”

In the relatively prosperous city of Foshan, near the southern Chinese city of Guangzhou, housing inventory could take 20 months to clear in one district and seven months in another district, according to a 2024 report by the Beike Research Institute. , a company affiliated with a major home sales platform in China.

Overall, the city saw space sold last year fall 16% to the lowest level in 10 years, according to the report.

Complicating China’s economic challenges are tensions with the United States. Similar to Washington’s export controls, Beijing has also made efforts to ensure national security by prioritizing domestic players in strategic sectors such as technology.

That stance has pressured an increasing number of European companies in China to localize – despite the additional costs and reduced productivity – if they want to retain customers in the country, the EU Chamber of Commerce in China said in a report. last week.

Chinese official statements have also emphasized combining security with development.

A motto of some of Beijing’s efforts to support growth is an effort to build “security capabilities in key areas“said Yang Ping, director of the investment research institute within the National Development and Reform Commission, during a press conference on Wednesday.

This year, “boosting consumption has been prioritized over improving investment efficiency,” Yang said in Mandarin, translated by CNBC. “Expanding and boosting consumption are the main goal of this year’s policy adjustment.”

He dismissed concerns that the impact of trade subsidies on consumption would fade after an initial spike, and indicated more details would emerge after the March parliamentary meeting.