Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

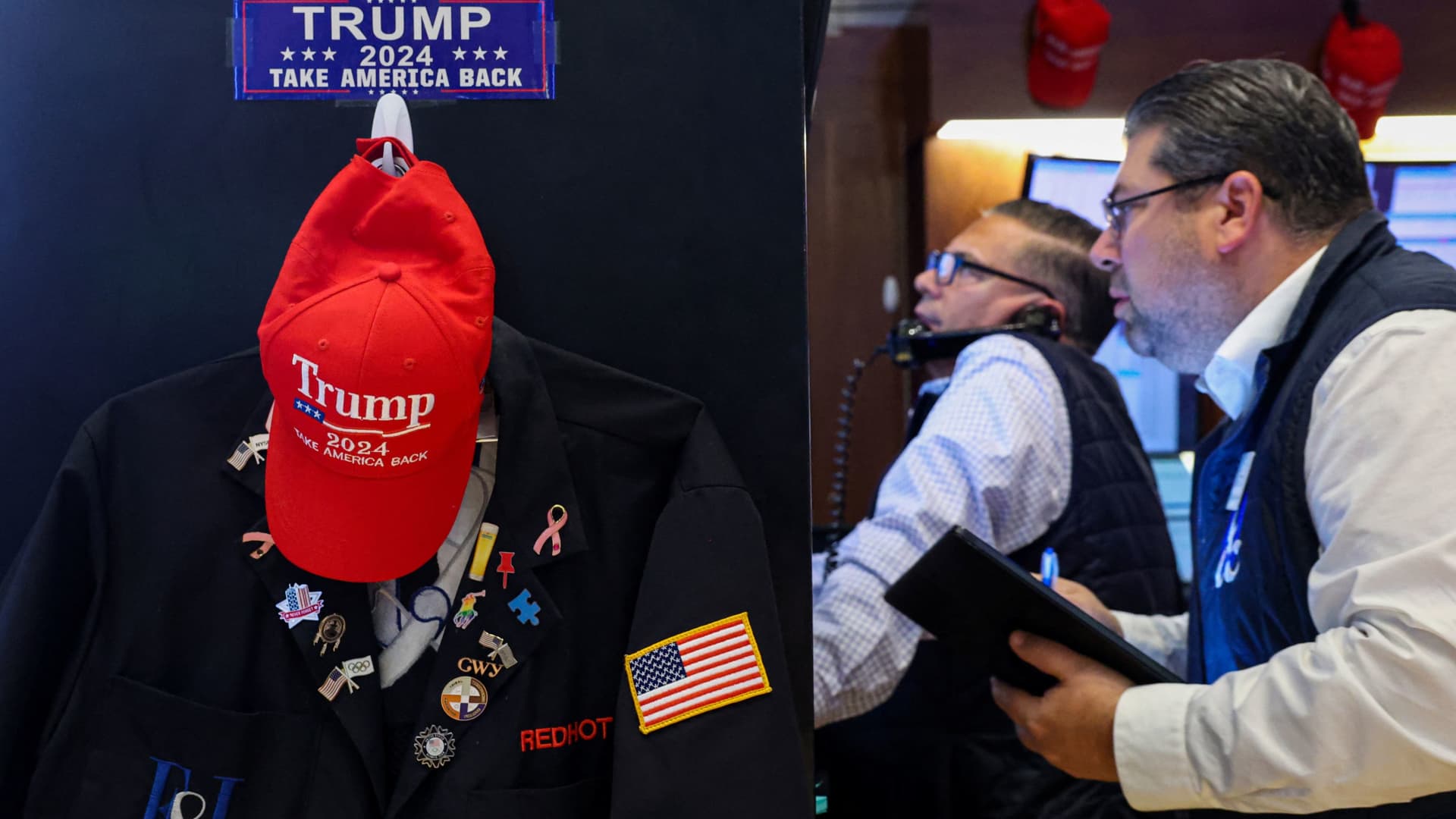

The New York Stock Exchange on November 25, 2024.

Brendan McDermid | Reuters

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Do you like what you see? You can subscribe here.

Stabilizing the yuan is a priority for Beijing

The offshore Chinese yuan has weakened more than 3% against the US dollar. presenting headaches for Beijingwhat do you want avoid currency volatility even as a cheaper yuan boosts exports. On Monday, China abandoned its reference interest rates unchangedsuggesting that keeping the yuan stable is taking priority over boosting the national economy.

Slowdown of Chinese investment in the US

Chinese investments in the United States have slowed sharply in recent years, according to the latest report. Data from the American Business Institute. Only $1.66 billion flowed into the US in 2023, well below the $46.86 billion in 2017. That trickle not likely to answer during US President-elect Donald Trump’s second term, due to “an ideological mismatch,” analysts said.

First winning week for US stocks in 2025

Markets in the US got up on friday to end the week higher for the first time in 2025. Asia-Pacific markets went up on monday. During the trading day, the Hong Kong Stock Exchange Hang Seng Index jumped to its highest level since December 31. Mainland China’s CSI 300 added about 0.5% as Beijing left its prime lending rates unchanged.

Reset Clock for TikTok

TikTok said in a statement about what is restoring service in the US after Trump wrote on his social media app Social Truth “would issue an executive order on Monday” to delay tiktok ban. On Saturday, Perplexity AI submitted an offer to TikTok’s parent company, ByteDance, for create a new merged entity combining Perplexity, TikTok US and new capital partners, CNBC has learned.

Oxfam predicts there will be trillionaires within a decade

He combined wealth of billionaires rose to $15 trillion from $13 trillion in 2024, according to Oxfam on Sunday. It is the second-largest annual increase in billionaire wealth since Oxfam’s records began. With the pace of wealth accumulation by the rich accelerating, the charity predicts there will be at least five billionaires within a decade.

TSMC confident of continued financing under Trump

Taiwan Semiconductor Manufacturing Co expects you to continue receiving the $6.6 billion was pledged. under the Biden administration CHIPS Act and Science Even after Trump takes office, TSMC CFO Wendell Huang he told CNBC in an exclusive interview. In the election campaign, Trump criticized the CHIPS Act and accused Taiwan of stealing the US chip business.

(PRO) Trump will determine the direction of the markets

Trump’s inauguration will take place later on Monday. Investors will want to keep an eye on what executive orders will Trump sign from day one of his presidency, especially when it comes to tariffs and corporate policies. Those orders could set the direction of the stock for much longer than the short term.

He S&P 500 It surpassed the brilliant 6,000 level following Trump’s election victory, but has largely erased all its gains and returned to its pre-election level in recent weeks. However, as Trump prepares to enter the White House, it appears that investors are preparing to play the market again based on his agenda.

Shares finally ended last week on a positive note, their first weekly gain of the year. For the week, the S&P 500 advanced 2.9% and the Dow Jones Industrial Average jumped 3.7%, its best weekly performance since the week of the US presidential election in November. He Nasdaq Composite It added 2.5%, its best week since the beginning of December.

Banks contributed heavily to the rise in indices, as better-than-expected earnings reports from big banks sent their stocks higher. Actions of Goldman Sachs rose around 12% in the week and JPMorgan Chase rose 8% in the same period. Overall, the financial sector rallied more than 6% last week, outperforming the S&P.

Trump’s tenure as president could provide a further boost to bank stocks. According to Chris Senyek, chief investment strategist at Wolfe Research, rising business and consumer confidence, an extension of tax cuts and deregulation of the financial industry are potential drivers for the sector.

“We continue to view the financial sector as the biggest sectoral winner under the Trump administration,” Senyek wrote in a note on Friday.

That said, aside from the anticipation that Trump will sit in the Oval Office, December’s consecutive weak inflation readings also boosted the animal spirit in the markets: all market sectors ended the week in the green.

The better-than-expected economic data has helped “reignite the goldilocks narrative for stocks and likely sparked some new risks.” Barclays wrote strategist Emmanuel Cau in a Friday note.

Normally, any change involves greater risks. That’s true with Trump 2.0, but as the number “two” suggests, a change we’ve seen before could mitigate that uncertainty a little.

— CNBC’s Alex Harring, Hakyung Kim and Sarah Min contributed to this report.