Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

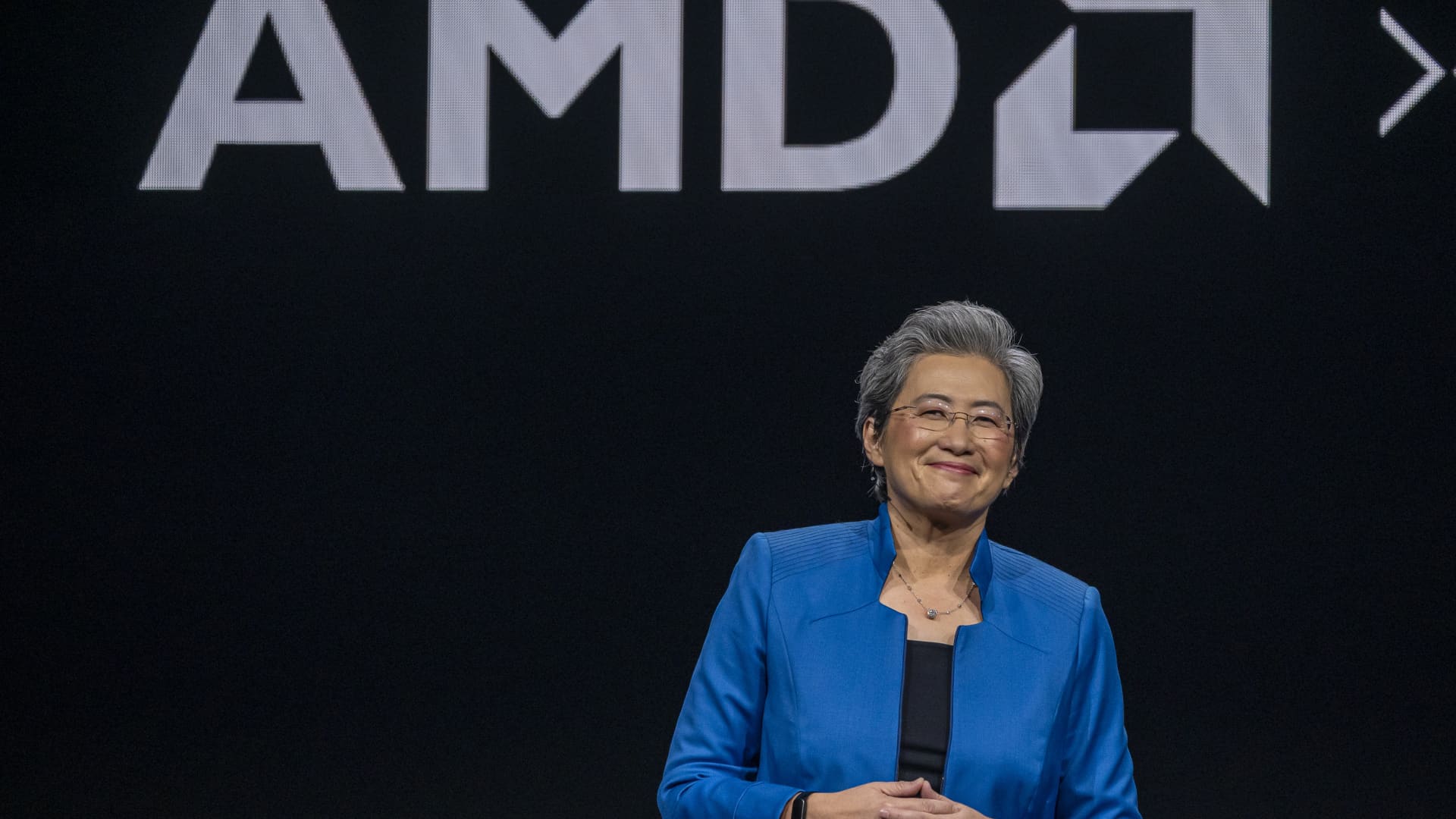

Lisa su, president and executive director of Advanced Micro Devices Inc., during the AMD Avancing AI event in San José, California, on December 6, 2023.

David Paul Morris | Bloomberg | Getty images

Micro Advanced Devices The shares fell 7% on Wednesday after the chip manufacturer did not deliver Wall Street estimates for its important data centers business.

The actions were negotiated in a minimum of 52 weeks and were on their way to their worst session since October.

AMD reported Better results than expected in the upper and lower resultsbut also reported sales of the $ 3.86 billion data center. That reflected a 69% growth a year ago, but it did not reach $ 4.14 billion in sales expected by analysts surveyed by LSE.

The key unit, responsible for selling advanced chips for data centers, has benefited in recent years of the growing demand for its graphics processing units, since Megacap technology companies run to develop advanced artificial intelligence tools.

The income of the data center grew 94% throughout the year to $ 12.6 billion, with $ 5 billion of sales derived from instinct GPUs focused on AMD AI. The company is the second largest producer for games later Nvidiawhich has triumphed as market leader in AI chips and has shot at a market value of almost 3 billion.

“We believe that this places AMD in a strong long -term growth trajectory, led by the rapid scale of our AI franchise of the data center of more than $ 5 billion of income in 2024 to tens of billions of dollars of annual income in the coming years, “AMD CEO, Lisa her, said in the gain call with analysts.

Several Wall Street companies cut its price objectives In the actions in the middle of the disappointing results and expectations of the data center for a weak first half. Citi reduced the actions to neutral of a purchase rating, while JPMorgan its objective to $ 130 from $ 180. Vivek Arya de Bank of America said that the company has not yet “articulated how it can carve an important niche” in relation to Nvidia .

Morgan Stanley highlighted the expectations of AI as the most significant pressure point, saying that “visibility probably needs to improve so that the stock finds its balance.”