Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Superlogic starting to apply consumers to apply the practice points made $ 200 million worth $ 200 million worth $ 13.7 million, and the company speaks to TechCrunch.

Lin Dai, CEO and Miami-based co-founder SuitableThe company’s technology is designed to “increase the value of premium points” by making consumers to use them. Its platform connects directly to existing lyorality programs for credit cards, airline and retailers.

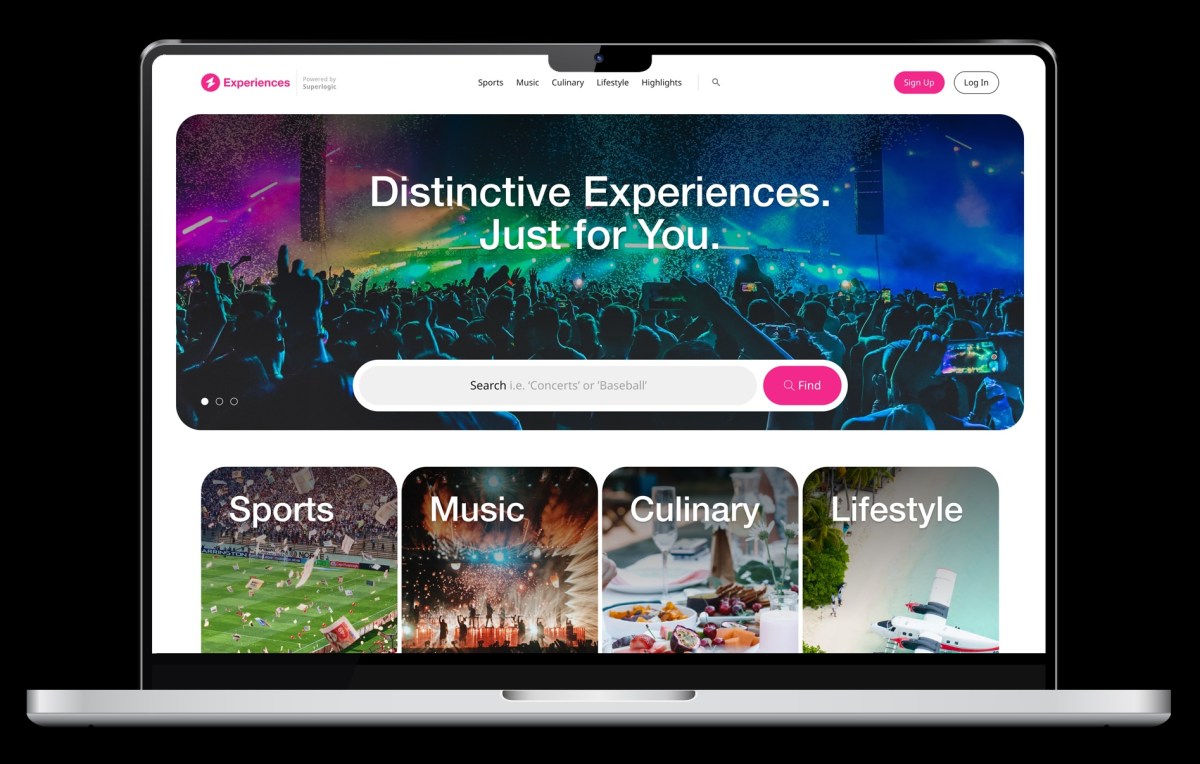

Superlogic partners to help consumers describe the consumers as a “experience catalog” explain that consumers can choose from instead of traditional points, such as a hotel stay or a commercial flight. Samples include NBA final tickets, “exclusive” tickets, music festivals, scenes from behind a broaday production or special dishes with top chefs

As the proposal is a white label, you will not necessarily use Superlogic technology when you receive rewards through American Express, MasterCard, Visa and Warner Music. The platform also manages the inventory of practices, negotiations with providers and manages payments on behalf of the brands.

Dai refused to disclose the figures of rigid income, in 2024, “eight digits” income “eight digits” and “an important increase of growth”.

Many people do not understand that the unused reward / honey can be considered responsible for a credit card company.

When the consumer earns points, the consumer explains the technical consumer and also explains.

“Thus, the credit card company is money that is owed to the consumer, for example,” he said. “For every 100 points, the award company has $ 1 where this debt should be set aside to return to its customers … and if a Fortune 500 brand is bankrupt, these points should actually be paid to the consumer.”

In other words, a company has the best interest in these points for consumers’ money.

Superlogic takes money by taking the things described as “a small margin percentage” for an experience that helps prevent transactions in carrying out a consumer operation.

“User accounts and credit card programs have no $ 25 billion situations sitting on the balance sheets,” he said. “Our okay is very high.”

Powerledger headed the rounded round. Sangha Capital, 10sq, Nima Capital, Actai Unicorn Foundation, Hyla Liquid Enterprise Foundation and Liquid 2 enterprise. Previous investors include Amex businesses, Warner music, Galaxy Interactive, Mirabaud Lifestyle, Removation, Change Capital, Capital of Capital and Sandoctor, the capital between others. Capital infusion has been financing the total capital of total capital of more than $ 21 million since 2017 since 2017.

Jemma Green, the executive chairman of Powerledger, said the brands “Excritant” sponsored and “thousands of deals to offer VIP experience to the most loyal customers,” he said.

He added: “The ability to attract consumers strongly with the minimum value and complexity is really a game change.”

Currently, the Superlogic consists of only 40 employees.

The company plans to use the new capital with about half programs this year.

Want more Fintech news in the Inbox? Sign up for TechCrunch Fintech here.

Want to contact a tip? Send me e-mail maryann@techcrunch.com Or send me a message about the signal 408.204.306. You can send a note to all TechCrunch Crew tips@techcrunch.com. For more reliable communication, Click here to contact usIncluded in connections with Securedrop and encrypted messaging applications.