Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Recently we received an email from Jane, who wrote us about a suspicious text message he received.

Your experience serves as a crucial reminder so that we all stay alert to these evolving digital threats.

We are going to immerse ourselves at Jane’s meeting and explore what it means to our financial security in 2025.

A person who receives a transfer alert scam text (Kurt “Cyberguy” Knutsson)

Jane wrote us with the following concern:

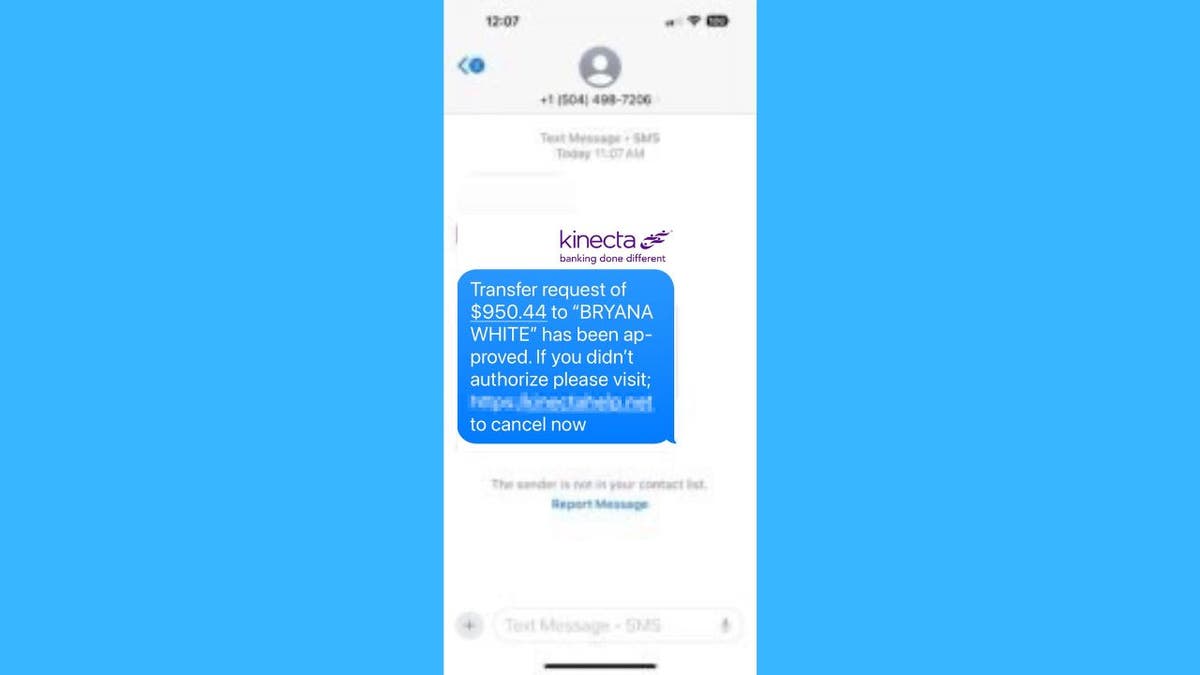

“I just received a Kinecta text Here in California That says: ‘The transfer application of $ 950.44 to Bryana White has been approved. If you do not authorize, visit (link here) to cancel now. Is this a scam text? Should I be worried? “

Excellent question, Jane! His precaution is commendable and, yes, he must worry. Let’s break this scam attempt and see why so many red flags.

Kinecta’s scam text (Kurt “Cyberguy” Knutsson)

Best antivirus for Mac, PC, iPhones and Androids – Cyberguy Picks

Jane’s text message exhibits several revealing signs of a scam that everyone must take into account:

Emergency as a weapon: Scammers exploit our fear of financial loss to cause hurried actions. They use phrases such as, in this case, “act now” or “Cancel now” and warn about the serious consequences if immediate measures are not taken. This urgency is designed to avoid rational thinking and avoid verifying the legitimacy of the application.

Suspicious links: Legitimate banks Avoid sending sensitive links to text safety. These links could download viruses on your device or take it to a false website designed to steal your personal information. Always verify the URL before entering any confidential data.

Specific but unknown details: The mention of “Bryana White” and the accurate amount of $ 950.44 is an intelligent tactic. Scammers often use specific details to create an illusion of legitimacy, even when these details are not familiar to the recipient. This approach aims to infuse doubt and urgency, increasing the possibilities of the victim acting hastily.

What is artificial intelligence (AI)?

Brand Supplant: Staff of often use brand supplant tactics, using similar logos, sources and schemes to create a legitimacy facade. This misleading strategy is designed to manipulate it to believe that it is interacting with a trusted institution, thus increasing the probability of falling into its scam.

Undoubted contact: Be careful with the unexpected texts that claim to be from your bank, especially if you have not registered for text alerts.

Spelling and grammatical errors: Look for mistakes in spelling, grammar or score. The legitimate messages of the banks are generally written by professionals and are free of errors.

Personal information requests: Scammers often ask you to “confirm” details such as your account or password. Legitimate banks never request confidential information by text.

Too good to be true offers: Be skeptical of messages that promise great returns or unexpected earnings.

Pressure tactics: Scammers often use a threatening language or impose adjusted deadlines to manipulate it to act quickly without thinking.

A person who receives a text from fraud (Kurt “Cyberguy” Knutsson)

How to fight against debit card pirates looking for their money

These digital deceivers have 3 clear objectives in mind:

Illustration of a scammer at work (Kurt “Cyberguy” Knutsson)

9 ways in which scammers can use their phone number to try to deceive it

As scammers become more and more sophisticated, it is crucial to arm themselves with knowledge and take proactive measures to safeguard their personal information. Here are seven essential tips to help you stay protected:

1. Never click suspicious links in text messages: In the case of Jane, clicking on the link could have led to a False Kinecta website designed to steal its login credentials.

2. Have a strong antivirus software: This can help detect and block the malicious software that could be downloaded if Jane had click on the scammer link. The best way to safeguard the malicious links that install malware, which potentially access their private information, is to have an antivirus software installed on all its devices. This protection can also alert it to the PHISHING Electronic Correos and Ransomware scams, maintaining their personal information and their safe digital assets. Get my elections for the best antivirus protection winners 2025 for your Windows, Mac, Android and iOS devices.

Get the Fox business on the fly by clicking here

3. Contact your bank directly with official channels: Jane should call the official Kinecta number to verify if there is any real problem with her account, instead of responding to the text.

4. Report the text to your bank and send it to 7726 (spam): In informing this text, Jane can help Kinecta and his mobile carrier to protect other customers from similar scams.

5. Enable two factors authentication (2FA) In your accounts: This additional security layer could prevent scammers from accessing Jane’s account, even if they obtained their password.

6. Use SMS filtering tools provided by your mobile carrier: These tools could have caught and marked the suspicious text of “Kinect” before reaching Jane’s entrance tray.

7. Invest on personal data elimination services: This can help reduce the amount of personal information available online, which hinders the scammers to point to Jane and you with personalized attacks in the future. While no service promises to eliminate all its Internet data, having an elimination service is excellent if you want to constantly monitor and automate the process of eliminating your information from hundreds of sites continuously for a longer period of time. See my best selections to obtain data disposal services here.

Remember, legitimate financial institutions will never press it to act immediately or click the links in text messages. In case of doubt, always contact your bank directly using official channels. Thank you, Jane, for calling this to our attention. His surveillance not only protected him, but also helps to educate others. Together, we can continue one step ahead of the scammers and protect our finances.

Click here to get the Fox News application

What additional steps do you think governments, regulatory agencies such as FCC or cell suppliers should take to stop the increase in fraud texts and protect consumers from these malicious schemes? Get us knowing in Cyberguy.com/contact

To obtain more technological tips and safety alerts, subscribe to my free Cyberguy Report newsletter when you head Cyberguy.com/newsletter

Ask Kurt a question or let us know what stories we would like to cover

Follow Kurt in his social channels

Answers to Cyberguys most facts:

New Kurt:

Copyright 2025 Cyberguy.com. All rights reserved.