Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

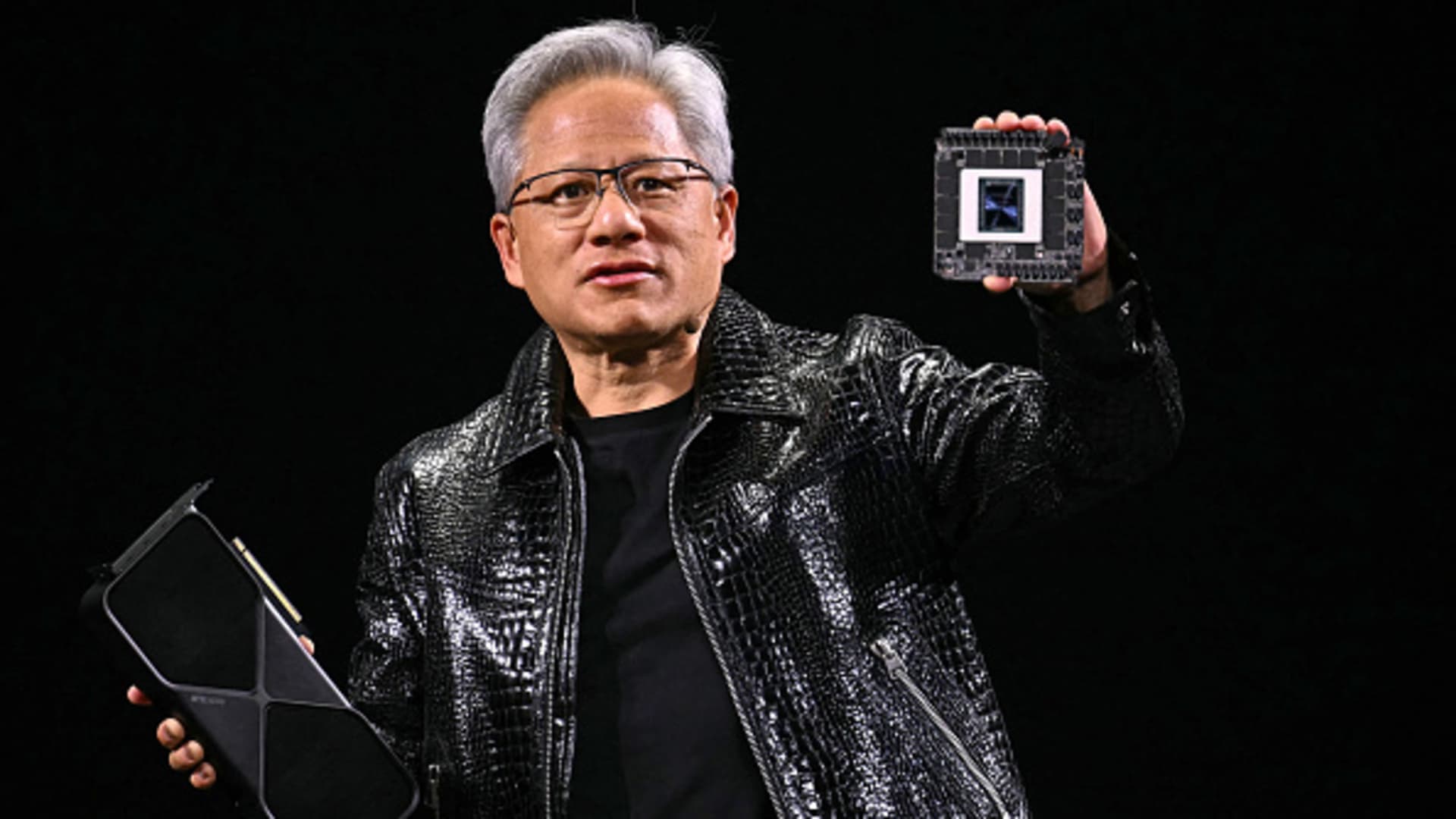

Nvidia CEO Jensen Huang gave a keynote speech at the Consumer Electronics Show in Las Vegas, Nevada on January 6, 2025.

Patricio T. Fallon | afp | fake images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Do you like what you see? You can subscribe here.

Technology drags down the Nasdaq

US markets were mixed monday. He S&P 500 and Dow Jones Industrial Average He got up, but Nasdaq Composite fell amid a broad tech sell-off. Asia-Pacific markets mostly traded higher on Tuesday. China’s CSI 300 rose about 2.7% and Hong Kong’s Hang Seng Index added 2.3%. Japan Nikkei 225the only outlier, fell almost 2% as the yield on the country’s 40-year government bonds rose to 2.766%, its highest level on record since 2007, LSEG data showed.

Possible new US steel supply

Cleveland Cliffs is partnering with the rival Nucor in a potential offer for American steelwhose acquisition by Japan Nippon Steel was blocked by the White House earlier this month, sources told CNBC’s David Faber. The offer would be for a share of $30. Nippon had planned to buy US Steel for $55 per share in a deal valued at more than $14 billion.

China’s electric car boom will slow by 2025: HSBC

Sales of new energy vehicles in Chinaincluding battery-only and hybrid-powered cars, will grow by just 20% in 2025, forecast HSBC analysts. This is a sharp drop from growth of 42% in 2024, according to data from the China Passenger Vehicle Association. The penetration of NEVs in new cars sold exceeded 50% in the second half of the year, according to the association.

Additional restrictions on chip exports

The United States will prevail new export restrictions in artificial intelligence chips, according to the level in which countries are classified, the United States government announced on Monday. For example, close allies of the United States will not face restrictions on accessing AI chips. Nvidia, the largest supplier of AI chips, called the rule an “absurd overreach” on Monday.

Will Elon Musk acquire TikTok US?

The Chinese government is considering a plan to sell TikTok’s US operations to Elon MuskBloomberg News reported Monday, citing anonymous sources. That would allow TikTok to continue operating in the country if the United States Supreme Court decides to ratify a law that Effectively Banning a Chinese-Owned TikTok in the US.

(PRO) Opportunities outside the “Magnificent Seven”

“Magnificent Seven” stocks fueled much of the S&P 500’s 23% returns in 2024. While one portfolio manager expects those stocks still have room to rise this year, he advises investors to be selective within the Magnificent Seven, and see opportunities in tech stocks outside that basket.

Tech stocks underperformed on Monday as investors took profits from the 2024 victors and searched for this year’s winner.

The tech-heavy Nasdaq Composite lost 0.38%. Big tech names popular with investors fell widely in Monday’s session. Palantir – he best performing stocks on the S&P last year—fell 3.4%, while Nvidia lost 2%, building on last week’s losses. Nvidia fell nearly 6% during the period, while Palantir lost more than 15%.

“In our view, that is a necessary part of a corrective phase and we are probably further along in this correction than many investors recognize, as many stocks peaked in late November and early December,” the director said. AXS Investments executive Greg Bassuk, adding that Friday’s jobs report “cemented” those concerns.

However, the S&P 500 rose 0.16% and the Dow Jones Industrial Average rose 0.86% as investors rotated into non-tech stocks such as amgen, Caterpillar and UnitedHealth.

That does not mean that these sectors will assume market leadership in the short term, or that they will assume the role of market leaders. Sector rotation is a common phenomenon in markets, as investors lock in their returns and look for the next stocks with upside potential. and the backdrop of rising rates puts more pressure on growth-oriented technology stocks than value stocks, which typically make up the Dow.

Furthermore, the artificial intelligence frenzy is not over, judging by the latest earnings information of TSMC and Foxconn, which operates as Hon Hai Precision Industry. Both companies saw their revenue increase thanks to the high demand for AI-related products.

A long-term rotation out of technology and AI is not likely. But one inside the field cannot be ruled out.

— CNBC’s Samantha Subin, Hakyung Kim and Brian Evans contributed to this report.