Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When merchants or companies start online, they usually start by partnering with one or two payment processors. But as they grow and expand into new regions, they often need to join additional payment partners to meet the needs of different customers (and sometimes regulators), a process that comes with some hurdles.

This has led to companies that will help manage the process. of Egypt MoneyHash — which helps merchants in the Middle East and Africa more easily manage complex payment stacks — raised $5.2 million to target larger enterprises. The Pre-Series A comes about a year after its last funding Announced a $4.5 million seed round In February 2024. In total, MoneyHash has raised over $12 million since then Nadir Abdelrazik and Mustafa holiday In early 2021, Egypt launched fintech.

MoneyHash’s industry is classically described as “payment arrangements,” and in a world of fragmented payments — where one business can work with dozens of different providers to accept, make and bank payments — its star has risen with online growth. transactions. Integrating multiple payment stacks can be operationally inefficient and technically complex, often taking internal tech teams weeks to complete. These difficulties are more evident in Africa and the Middle East due to different payment methods and currencies. This is where payment orchestration platforms come into play by connecting and simplifying these payment processes across regions via an API.

Abdelrazik and Eid founded MoneyHash after years of working in fintech and enterprise software and witnessing some challenges. Simply put, fees are (perhaps obviously) central to how a business operates, grows and makes a profit. But it was often a costly and risky bottleneck, especially for smaller merchants: payment failure rates in the region are three times higher than the global average, and cart abandonment is more than 20% higher than in developed markets. They saw orchestration as the solution: merchants without payment orchestration platforms are at the mercy of high transaction costs, revenue leakage, and will struggle to scale across regions, they believe.

“The opportunity to solve this is huge,” said CEO Abdelrazik. “In emerging markets, digital payments represent only a fraction of the total transaction volume, indicating huge growth potential over the next decade. We built MoneyHash specifically to help merchants overcome these complex challenges and transform payments from a liability to a strategic advantage.”

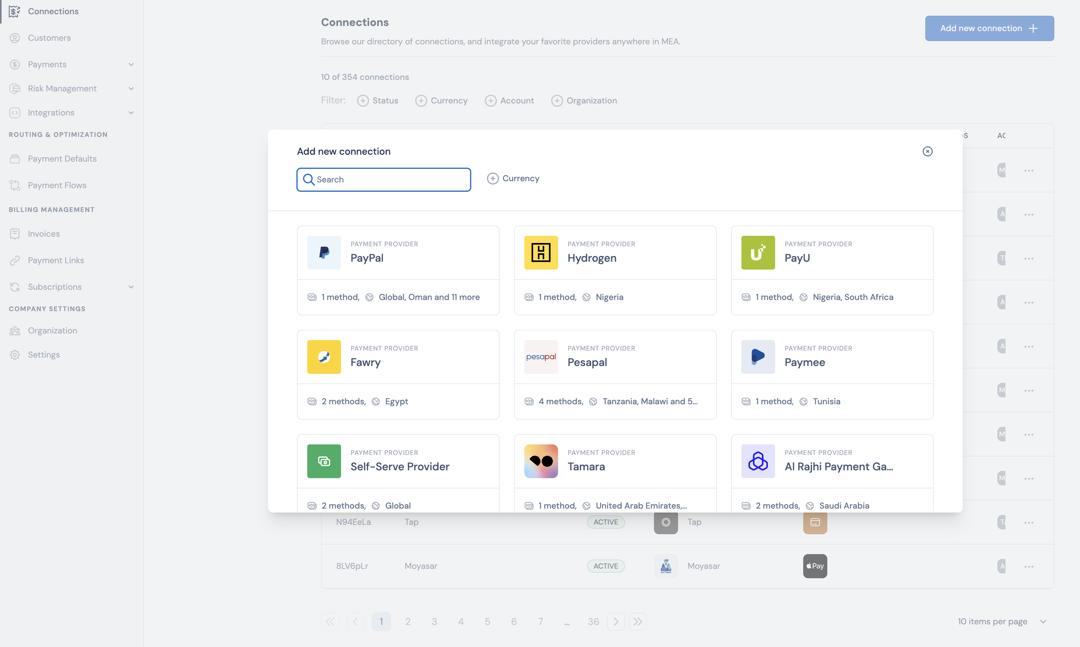

MoneyHash integrates with merchant payment providers to give its customers a streamlined way of working across the stack. It offers features such as a single API for checkout and payment transactions, customizable verification, advanced transaction routing with fraud prevention, failure rate optimization, and detailed reporting tools. The company also supports recurring payments, virtual wallets, subscription management and payment links, providing an “all-in-one solution” for merchants.

Just like you have a16z support Payment methodsIn the US, UK and Europe, Spreedly, Zooz and Primer, MoneyHash serves clients in the Middle East and Africa. What sets MoneyHash apart, Abdelrazik said, is its focus on emerging markets and more than 300 pre-integrated APIs (with local and international processors and gateways such as Adyen, Amazon Pay, Checkout, Fawry, Mono, Stripe, Tabby) which has a wide integration network , and ValU) covers more than 100 markets. Supported by QED PriceA South African startup provides similar services in the region.

MoneyHash initially focused on small merchants, but in early 2024 began targeting larger enterprises with the launch of an enterprise suite, which allowed the company to gain significant scale.

“Without us, you can still make many performance improvements that take years of work and learning. But when you add our software, all payment performance indicators are at their highest possible level. We’re talking about authorization, conversion and fraud rates. And we’re pretty comprehensive,” said CEO Abdelrazik.

“We don’t focus on just one performance indicator to try to solve all the problems across the entire payment chain lifecycle that enterprises need. The company does not want to solve a problem. They will look for other problems. They want an end-to-end solution throughout the payment cycle, and that’s what we do.”

Enterprises across industries such as consumer fintech, hospitality, e-commerce and gaming now account for 35% of MoneyHash’s customers, a threefold increase by 2024. Key clients include BNPL unicorn Tamara, cloud kitchen leader Kitopi and e-commerce platform Brands For Less. .

According to Tamara’s head of payments, MoneyHash stands out in the region by “making a significant difference”, citing claims of possibly helping clients achieve a 10-20% increase in revenue by reducing market access. and development costs are 90%.

Meanwhile, Abdelrazik credits his startup’s venture pipeline and long-term contracts that helped secure pre-Series A funding. According to him, these customers have increased their processing volume by 4 times and their income by 3 times over the past year, although specific figures are not disclosed.

Global fintech investor Flourish Ventures led the round. Other investors include Saudi Vision Ventures, Arab Bank’s Xelerate and Emurp Kepple Ventures. The round also welcomed the participation of Jason Gardner, founder and former CEO of Margeta (his first check in the region), and existing investors Github founder Tom Preston-Werner and COTU Ventures.