Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

By Leika Kihara and Makiko Yamazaki

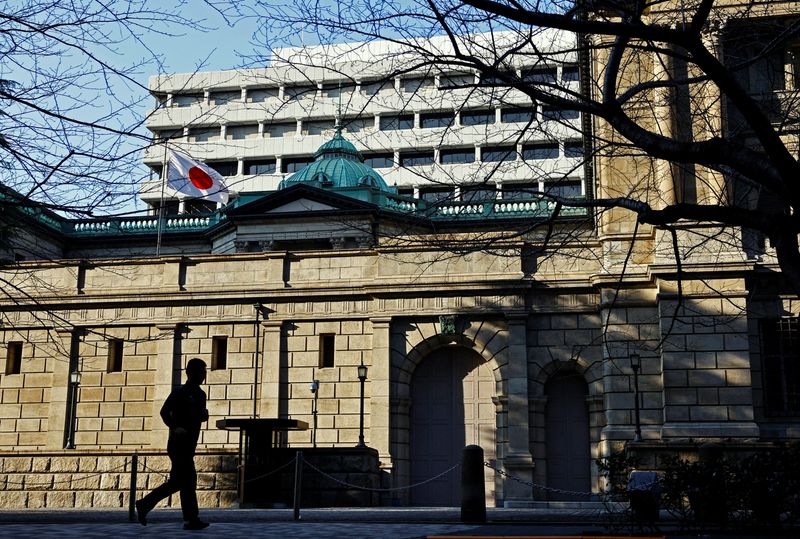

TOKYO (Reuters) – The Bank of Japan raised interest rates on Friday to the highest level since the 2008 global financial crisis, underscoring its hope that rising yields The hike will keep inflation steady around its 2% target.

The decision marks its first rate hike since July last year and comes days after the inauguration of US President Donald Trump, which is likely to keep global policymakers on alert. before the possible consequences of the threatened higher tariffs.

At its two-day meeting concluding on Friday, the BOJ raised the short-term policy rate from 0.25% to 0.5% – a level not seen in Japan in 17 years. by a vote of 8-1 with board member Toyoaki Nakamura opposed.

The widely expected move underscores the central bank’s willingness to raise interest rates to 1% – which critics say will neither cool nor overheat Japan’s economy.

“The likelihood of achieving the BOJ’s vision is increasing,” with many firms saying they will continue to raise wages consistently in annual earnings talks, the central bank said in a statement announcing the decision. that.

“Underlying inflation is rising towards the BOJ’s 2% target,” the central bank said, adding that the stock market remained generally stable.

The BOJ did not change its guidance on future policy, saying it will continue to raise interest rates if its economic and price forecasts come true. But it removed the clause emphasizing the need to analyze the risks related to the economy and overseas markets.

“Their views are still the same. They are still far from neutral, so it is natural to make a change,” said Naka Matsuzawa, chief macro strategist at Nomura Securities in Tokyo.

“Unless the BOJ changes the idea of a rate hike, or raises the neutral point, which they have been thinking about – about 1% – there is not enough room for the market to buy more prices in the future.”

The yen rose around 0.5% to 155.32 per dollar after the decision, while the two-year Japanese government bond () yielded.

Attention now turns to any details from BOJ Governor Kazuo Ueda in his post-meeting briefing at 0630 GMT on the pace and timing of further hikes.

In the quarterly outlook report, the board raised its price forecasts to core inflation project running at or above its 2% target for three consecutive years.

It also said that risks to the inflation outlook have shifted into a growing labor shortage, rising rice prices and increased input costs from the weak yen.

“Regarding the annual wage negotiations, there were many opinions expressed by firms that they would continue to raise wages in a sustainable manner,” the report said.

The head of Japan’s union umbrella group told Reuters on Friday that Japan’s annual wage growth should exceed the 5.1% secured last year as real wages continue to fall.

The board now projects that core consumer prices will reach 2.4% in fiscal 2025 before falling to 2.0% in 2026. In the previous estimate made in October, it expected inflation to hit 1.9% in both of the 2025 and 2026 budgets.

It made no change to its forecast that Japan’s economy will grow by 1.1% in fiscal 2025 and 1.0% in 2026.

While the US economy remains strong and financial markets are generally stable, the BOJ must be alert to doubts about the conduct of US policy, the report said.

“A rise may be expected but for what appears to be the first time in a very long time, there hasn’t been a significant downgrade in their economic outlook,” said Matt Simpson, an analyst. chief marketer at City Index in Brisbane.

“This keeps the door open for another 25bps hike towards the end of the year, with rates staying above 0.75%.

Japan’s core consumer prices rose 3.0% in December, the fastest annual pace in 16 months, data showed earlier on Friday, a sign of rising fuel prices and inflation. food prices continue to increase the cost of living for families.

After taking the helm in April 2023, Ueda dismantled the predecessor’s strong stimulus program in March last year, and raised short-term interest rates to 0.25% in July.

BOJ policymakers have repeatedly said the central bank will keep raising rates, if Japan progresses into a cycle in which higher inflation increases wages and boosts consumption – thereby allowing firms to continue to pass on higher costs.