Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

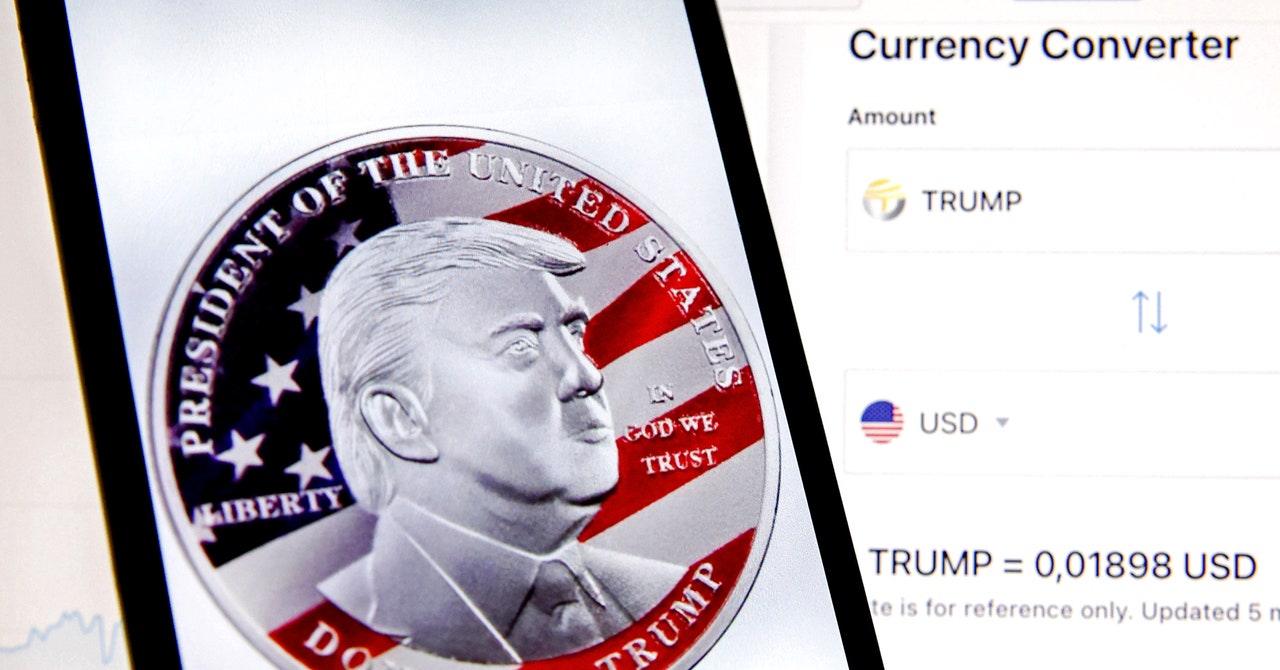

Cryptovalutions investing the largest amount in Trump, according to Nansen analysis, was purchased on January 18, January 18. The smallest income of Trump investments, meanwhile, bought a large number of holdings by January 20. Trump coins that period are now valued at $ 5.4 billion.

“Previously, you can bet one. But if you bet a lot, it doesn’t make sense to stay for a long time because it will not be (next) apple or nvidia.” “There’s a zero value. Therefore went to make sure.”

Between the wallets the most beautiful profitable Data from Trump to Nansen, many have been used in relatively small amounts, which has defeated the crowd of some regular people in the same way with great traders. J9TXV and Trump’ın in the middle of high-value trading placed in a few minutes away from the start of the beginning, Armchair traders Throwing up to $ 50.

Fortune and Gall, sibenic and beyond the incredible shot of the civilian and powers, only one other theory can explain the merchants flowing for hundreds of thousands of dollars for hundreds of thousands of dollars: traders were placed by automated sniper bots.

Sniping Bots is usually programmed to catch more than one different coins immediately after the start. Some of the wallets used to place early high-value Trump trades contains dozens of other memorybut Othersincluding J9exvconsists of several people.

“What we will not wait to see a bot is only a great position, especially if the sign has not been previously announced, it seems very specific.” This activity seems very specific, “the powers. “How do you codve to get a miracle of script for a bot?”

Most sniper bots are also programmed to work in the amount of small dollars, Sibenik says. “(Great early traders) are more explanatory, especially, especially considering a very large amount of insiders, or another party,” Sibenik says.

In the absence of any rules that regulate memories in the United States, it may not be illegal for an issue to give an early notice to select parties.

Recently, more than one Federal Fights brought by investors The securities and exchange commission managed by Memecoins, Securities and Exchange Commission must undergo laws of securities managed by the assignment of US investors. But in an interview The enterprise, which is determined by Trump as the United States on January 23, is the capitalist David sacks The ai and crypto tsarA kind of gathering of memecoins claimed to be taken as an unregulated asset class.

At an executive order signed on January 23, Trump A “Working group on digital assets“The task of regulating the relevant cryptist and the legislation.”

“The cryptocurrency industry still clarifies the regulation. The main players want to see them as good faith in the financial markets,” they say. “This is some of the dissatisfaction expressed in the industry that offers this memeCoin (Crypto) industry.”

At the foot of Trump WebsiteTo refuse a small print, Memecoin claims “an investment contracts, investment contract or any type of security, or not intended to be.” This ConditionsMeanwhile, investors intend to give up the right to bring a class of class related to Memecoin. They also claim that investors have not taken place and “distorted” and “distorted” by the trump-related company that governs “deceptive and unfair trade experiences” and the coins.

“This is a surprising warning,” he says powers. “It is another matter for such refusal and rejects to actually in court. However, it is not in the hope of the crypto industry to turn the path of previous visitors.”