Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

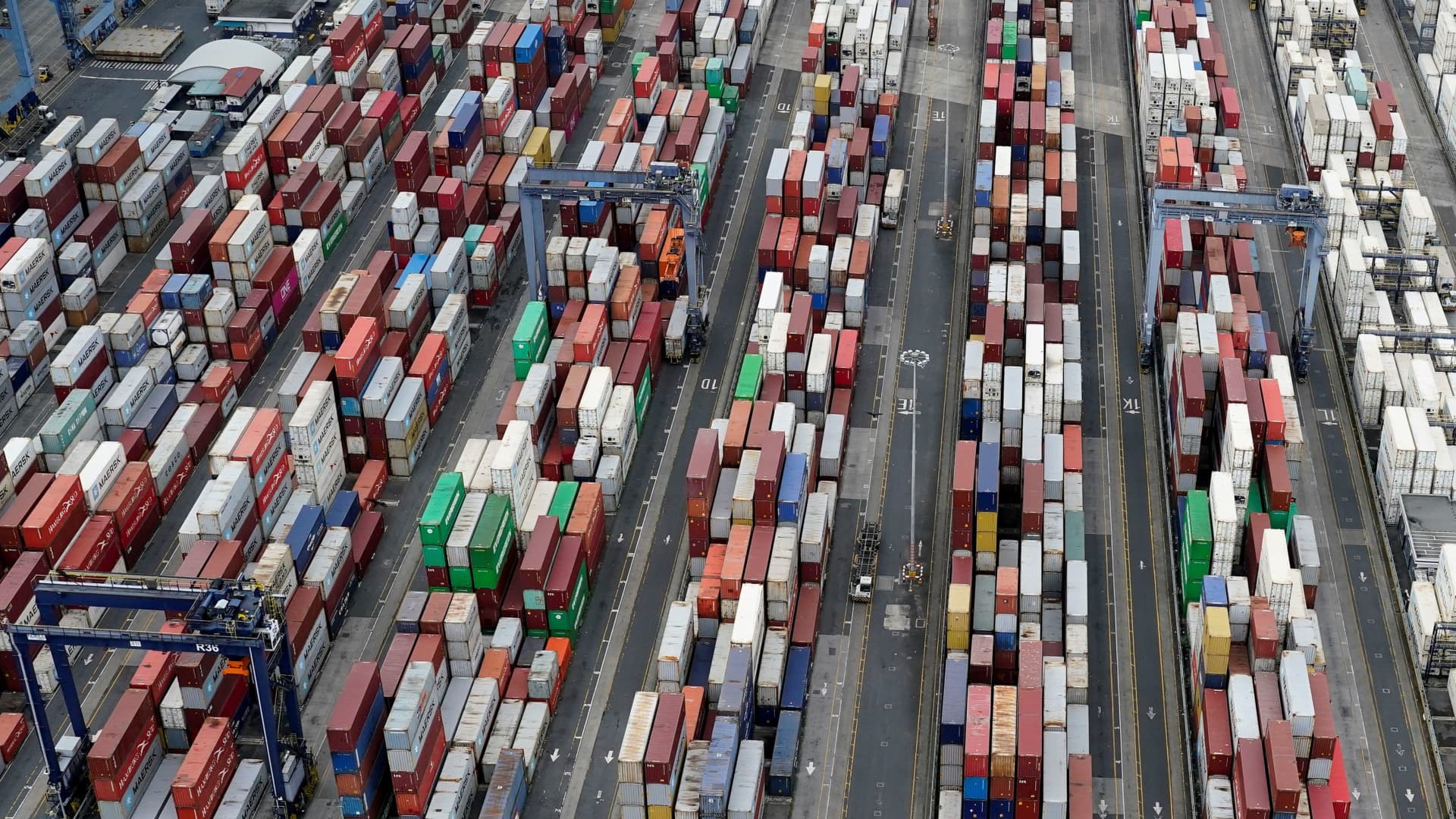

An aerial view shows containers stored in the port of Balboa, operated by Panama Ports Company, while the president of the United States, Donald Trump, plans to recover control of the channel, in the city of Panama, Panama, on February 1, 2025 .

Enea lebrun | Reuters

This report is from CNBC Daily Open today, our International Market Bulletin. CNBC Daily Open puts investors a day with everything they need to know, regardless of where they are. How do you see? You can subscribe here.

Trump tariffs enter into force

President of the United States Donald Trump launched a rates save On Saturday. Imports from Mexico and Canada will be affected with a 25%duty, while China’s will be subject to a 10%rate. Canada’s energy resources will face a lower 10%rate. Tariffs on Canadian goods are expected to enter into force at 12:01 am et on Tuesday. Canada’s Prime Minister Justin Trudeau announced the same day 25% retaliation rates against $ 155 billion In American goods.

Inflation remained stable in December

Wall Street finished 2024 by a maximum, but also inflation in the US increased 2.6% annually in December, reported The United States Department of Commerce on Friday. That increases 0.2 percentage points since November and in line with the estimation of Dow Jones. Core PCE, which eliminates food and energy prices, occurred since the month before 2.8%, also in line with expectations.

For shares, a January winner amid uncertainty

American markets retired on Fridayrenouncing previous earnings, in news of Trump’s imminent rates. He S&P 500 lost 0.50%, the Dow Jones industrial slid 0.75% and Nasdaq compound 0.28%fell. However, the three indices ended in January in the Green. That said, Stock futures fell on Monday morning. Paneuropeo Stoxx 600 iNdex increased 0.13%, Noting a 6% gain for January – higher than the increase of S&P 500 of 3%.

Depseek could have cost 100 times more

The Chinese artificial intelligence startup, the sophisticated AI of Deepseek, supposedly costs only $ 5,576 million to train, according to a Technical Report. That number excludes previous research costs, calculates expense and other processes. TO New Semi -sis ReportA semiconductor research and consulting firm, estimates that Deepseek hardware spending is “Well, more than $ 500m about the history of the company “.

(Pro) Week full of profits and questions

The profit season is launched this week, with more than 120 S&P 500 companies scheduled to inform. Investors and analysts are not only going through the results, but they will also want to analyze how CEO responds to Questions about Trump’s rates. Meanwhile, the January job report will be on Friday, and the expectations of economists are slightly silenced.

The rates of the president of the United States, Donald Trump, are no longer a threat but a reality. They reached a wild January during which a new president entered the White House and a new Chinese artificial intelligence model overturned the industry.

Something more that was new in January: the highest closing level for the S&P 500.

But with tariffs now instead, a possible War of the Commercial War, which makes it more difficult for inflation, apparently trapped in place, backward, markets may have difficulty climbing new heights in the short term.

Even the great technological gains and the employment numbers that will come out this week, usually reports that move in the market, can play the second violin for policy developments.

A small consolation to the markets: the total cost of Deepseek could be more than $ 500 million, estimated a research firm. (The $ 5 million figure established by Deepseek comprises only its training cost). I could give the companies related to a spring in their steps.