Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Republicans of the House of Representatives are running to anticipate their Senate counterparts on the plans to approve a conservative policy legislation and advance to the president Donald Trump’s agenda.

The plans to take the first step in the budgetary reconciliation process this week were sunk in the Chamber, with tax hawks pushing the leaders of the Republican Party to raise their proposed floor for the expense cuts after balanced in an initial initial proposal presented Last month in the House of Representatives of the House of Representations of the House of Representatives in Miami.

Meanwhile, the Senate is moving all the steam ahead With your own plan to advance a budget resolution on Wednesdays and Thursdays. The president of the Senate Budget Committee, Lindsey Graham, RS.C., presented the upper chamber plan on Friday.

The president of the House of Representatives, Mike Johnson, Republican of La-La., Told journalists that same day that he hoped that the Budget Committee of the House of Representatives would assume the resolution of the lower chamber on Tuesday.

Scoop: Key conservative caucus Draw the red line in the house budget plan

On Wednesday a plan to jump to the Republicans of the House of Representatives on the reconciliation process to the senators was revealed. (Reuters)

“We have some more people we have to talk to and a couple more boxes to verify, but we are almost there,” said Johnson. “The expectation is that we will mark a budget next week, potentially as soon as Tuesday, the resolution. That, of course, will begin the process and will unlock the entire reconciliation process, which I think we can conclude in a brief amount of time” .

Two legislators of the Republican party on Friday told Fox News Digital that the Plan would require a minimum of $ 2 billion to $ 2.5 billion in expenses of expenses for a period of 10 years.

Republicans plan to use their majorities in the Chamber and the Senate to approve a wide strip of Trump policy initiatives, from extending the 2017 tax and job cuts law to channeling more effective operations at the border between the United States and Mexico .

The budget reconciliation process makes it possible by reducing the threshold for the approval of the Senate from 60 votes to a simple majority of 51 seats. Because the Chamber already operates in a simple majority threshold, it will allow Republicans to avoid the democratic opposition to approve its agenda, provided that the measures included involve budgetary issues or other tax issues, as required by reconciliation rules.

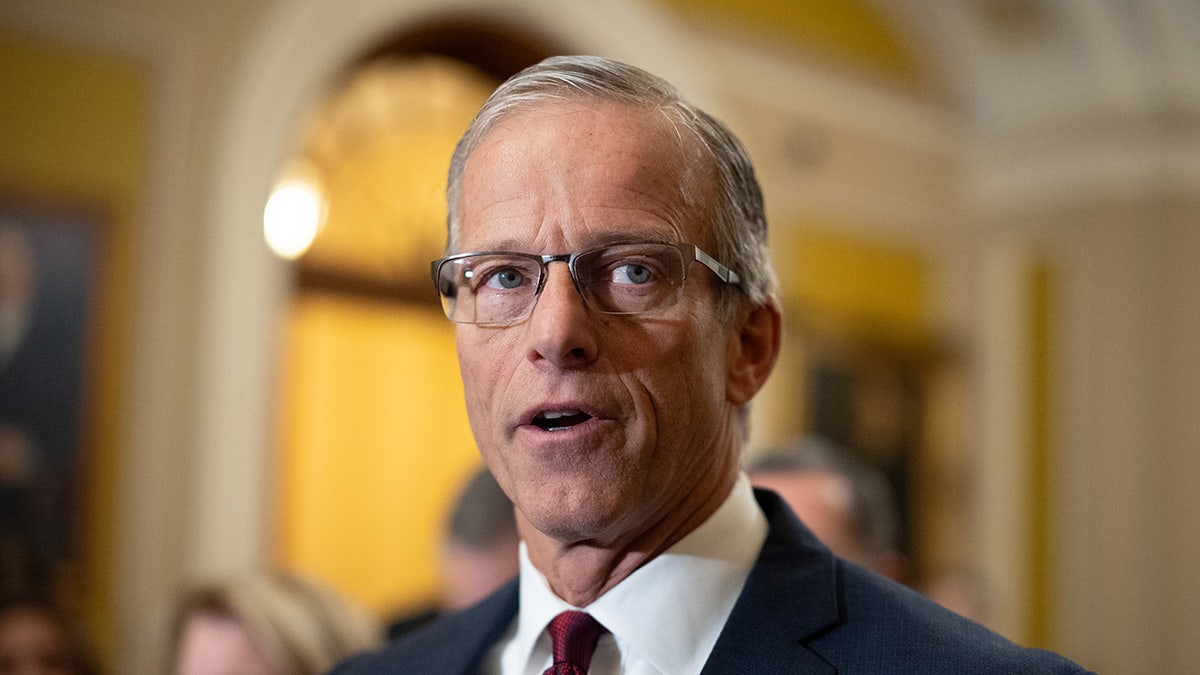

The leader of the majority of the Senate, John Thune, RS.D., leads his camera in a draft law of reconciliation of two tracks. (Getty images)

A group of camera Republicans, including Johnson, was in the White House on Thursday to discuss the process.

Trump told legislators He wanted The conciliation plans to include the elimination of taxes on the salaries of the tips and the overtime, there are no taxes on older people and there are no taxes on social security payments.

Although they agree on the general policies that must be approved through the reconciliation process, the Republicans of the Chamber and the Senate differ in their favorite approach.

Republicans of the House of Representatives aim to put all Trump priorities in taxes, border security, energy and defense in a large bill, complete with deep expenses cuts to compensate for new funds.

The president of Black Caucus accuses Trump of ‘purge’ of federal ‘minority’ workers’

The president of the Ways & Means committee, Jason Smith, R-MO., Is among the largest proponents of a single factor approach. (Tom Williams)

Meanwhile, the Senate plan would divide the process into two bills. The first, presented by Graham on Friday, includes the border policies, energy and defense of Trump. A second bill would deal with taxes.

Click here to get the Fox News application

But the leaders of the Republican party are concerned that the intense political maneuvers that take the process will mean that they run out of time before approved a second bill with Trump’s tax cuts at the end of this year.

A memorandum of the Committee of forms and means sent earlier this year projected that the average American home could see that taxes increased by more than 20% if those provisions expire at the end of 2025.

Trump himself has repeatedly asked for “a large and beautiful bill,” but said he was not finally worried about the packaging while all his priorities were approved.